Imagine yourself, as a dedicated member of your finance or accounting team, at the heart of a significant transformation. Your position isn't just about crunching numbers anymore; it's about leading the authority into a digital future that promises to revolutionize the way you work, making your expertise even more crucial. In today's rapidly growing business landscape, the integration of technology has become more than just a strategic choice, it’s essential for business survival & growth. This journey of technological evolution, known as Digital Transformation, has not only changed the way we do business but has also redefined the very essence of finance & accounting functions. Digital transformation is the future of business. Are you ready to welcome it? Let’s see!!!

Understanding Digital Transformation and Its Evolution:

Digital transformation is the process of using digital technologies to enhance your business growth. It helps you become more efficient, productive & customer-centric.

It is a journey, not a destination & it is continually developing as new technologies emerge. The growth of digital transformation can be divided into four main phases:

1. Adoption:

This is the earlier phase of digital transformation organizations simply embrace new digital technologies to replace their existing ones. For example, a business can switch from paper-based to electronic records, or from a traditional phone system to a VoIP system.

2. Integration:

In this phase, organizations begin to incorporate their new digital technologies with their existing systems & processes. This can be a difficult & challenging process, but it is important to get right if organizations want to discover the full advantages of digital transformation.

3. Transformation:

This is the stage where organizations start to fundamentally change their business processes & models to take benefit of digital technologies. For example, a company may shift to a cloud-based infrastructure, or start using data analytics to enhance its decision-making.

4. Evolution:

In this final phase of digital transformation organizations regularly adapt & develop their use of digital technologies to reach the changing market demands.

The evolution of digital transformation is not an unbent procedure. Organizations may move back & forth between the various phases & they may sometimes fail in their efforts. However, the organizations that are able to successfully embrace digital transformation will be the ones that are best positioned to succeed in the future.

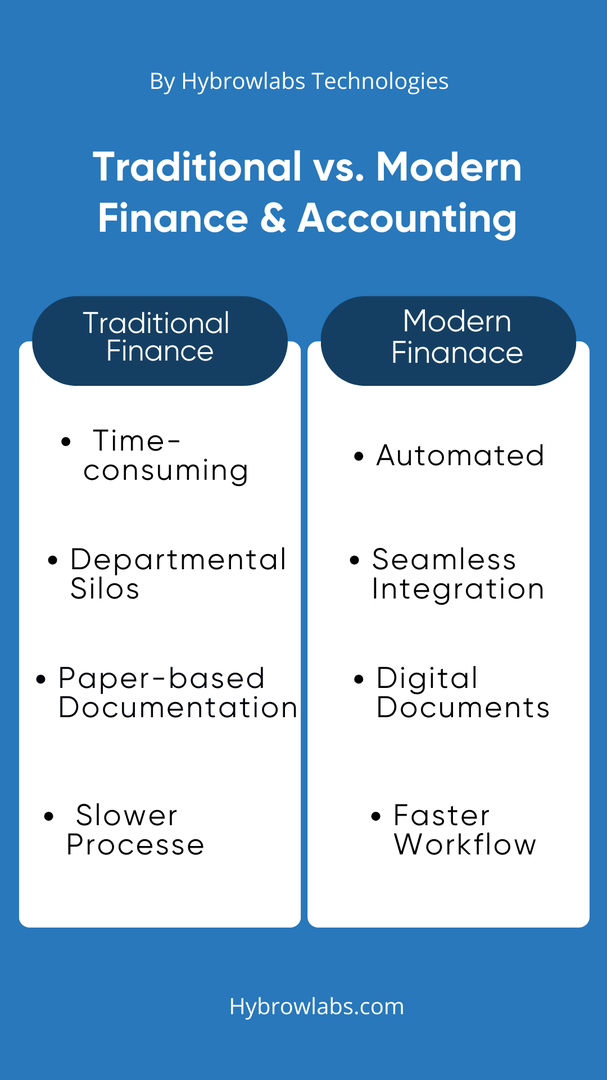

Traditional vs. Modern Finance & Accounting:

In the ever-evolving world of finance & accounting, a seismic shift is underway – a transition from the traditional to the modern. This transformation is fueled by digital technology & understanding the differences between the two approaches is pivotal in recognizing how digital transformation can be beneficial. Let's explore this journey:

| Aspect | Traditional Finance & Accounting | Modern Finance & Accounting with Digital Transformation |

| Processes | Manual, paper-based processes & time-consuming. | Automated, streamlined processes & reduced manual tasks. |

| Integration & Collaboration | Departmental silos & limited communication. | Seamless integration, real-time data sharing & collaboration. |

| Data Analysis | Historical reporting & retrospective view. | Real-time analytics & proactive decision-making. |

| Documentation | Paper-based documentation & cluttered offices. | Digital documents & accessible from anywhere. |

| Compliance | Manual compliance checks & risk of non-compliance. | Automated compliance processes & reduced compliance risk. |

| Efficiency | Reliance on manual labor & slower processes. | Enhanced efficiency, reduced errors & faster workflows. |

| Decision-Making | Informed by historical data & reactive. | Data-driven, real-time insights & proactive decisions. |

| Cost Savings | Higher operational costs due to inefficiencies. | Cost savings through streamlined processes. |

| Collaboration | Limited cross-functional collaboration. | Enhanced collaboration and cross-team alignment. |

| Adaptability | Slower adaptation to market changes. | Quick adaptation to market shifts & regulatory updates. |

| Data Security | Traditional security measures & potential risks. | Robust data security measures & reduced data breach risks. |

The Power of Digital Transformation in Finance and Accounting Teams:

Digital transformation is not about replacing humans with machines; it's about empowering your team to reach new heights of efficiency, accuracy & strategic impact.

So, what's the role of digital transformation in finance & accounting teams? Let’s explore:

1. Improved Financial Efficiency:

Digital tools automate repetitive, time-consuming tasks such as data entry & reconciliation, enabling finance teams to process transactions more efficiently. This efficiency boost allows for better allocation of resources & more focused analysis.

2. Accurate Financial Data:

Automation reduces the risk of human error, ensuring that financial data, critical for Finance and accounting, is more reliable & error-free. This accuracy is paramount for financial reporting, compliance & data-driven decision-making.

3. Real-Time Insights for Finance and Accounting:

Digital transformation provides Finance and accounting teams with access to real-time financial data & analytics. Monitoring key financial performance indicators (KPIs) in real-time allows for quicker responses to market changes & better-informed financial decisions.

4. Cost Savings Finance and Accounting:

By automating processes & reducing errors, digital transformation leads to significant cost savings for Finance and Accounting teams. This cost efficiency allows for strategic resource allocation within the financial domain.

5. Strategic Financial Decision Support:

Digital tools facilitate data-driven decision-making within Finance and Accounting. Advanced analytics enable Finance professionals to identify trends, predict financial outcomes & provide strategic recommendations to the organization's leadership.

6. Enhanced Financial Reporting:

Modern financial reporting, especially critical in Finance and Accounting, is no longer confined to static documents. Digital transformation enables interactive & dynamic reporting, making it easier to communicate complex financial information to stakeholders.

7. Secured Financial Data:

Finance and Accounting deal with sensitive financial data. Digital solutions provide robust security measures to protect this critical information from breaches & unauthorized access.

How to Start Digital Transformation for the Finance and Accounting Team?

Like any transformative endeavor, it requires careful planning & execution. Now let’s discuss the crucial steps to kickstart your digital transformation initiative. Whether you're just beginning or looking to refine your existing strategy, these insights will help you chart a successful path toward a digitally empowered finance and accounting team.

Step 1: Visionary Goal Setting

- Engage Your Team: Kickstart the transformation process by gathering your finance & accounting team for a brainstorming session. Encourage them to envision the future where their roles are more strategic, efficient & impactful.

- Define Clear Objectives: Work collaboratively to set specific, measurable & time-bound objectives. For example, aim to reduce manual data entry by 50% within six months or achieve real-time financial reporting by the end of the year. This establishes a roadmap for success.

Step 2: Deep Dive into Current Processes

- Process Mapping: Dive into your current processes, from invoice handling to financial reporting. Involve your team members in documenting each step of these processes, emphasizing the need for accuracy & efficiency.

- Identify Pain Points: Encourage your team to identify pain points they encounter daily. Is it a cumbersome approval process, the time wasted on reconciliations, or data entry errors? Make a list of these challenges.

Step 3: SMART Goal Formulation

- Smart Objectives: Building on the objectives set in Step 1, make sure they are SMART. For example, "Automate invoice processing to reduce manual errors by 20% in the next quarter."

- Team Commitment: Ensure your team members understand these goals & are committed to achieving them. Ask for their input on how to reach these objectives.

Step 4: Assemble Your Transformation Team

- Cross-Functional Team Formation: Create a cross-functional transformation team comprising finance, accounting, IT & other relevant departments. Assign roles based on expertise & interest, making sure everyone feels they have a critical role to play.

- Team Empowerment: Empower your transformation team with the authority to make decisions & drive change. Highlight their importance as change agents within the organization.

Step 5: Embrace Cloud-Based Tools

- Selection and Training: Together with your IT and finance teams, carefully select cloud-based financial software that aligns with your objectives. Provide hands-on training to ensure everyone is comfortable with the new tools.

- Benefits Showcase: Show how these tools simplify everyday tasks. For instance, demonstrates how cloud accounting software reduces manual data entry & provides real-time access to financial data, enabling better decision-making.

Step 6: Automation and Efficiency Gains

- Identify Automatable Tasks: Engage your team in identifying tasks that can be automated. Start small, perhaps with invoice processing or expense reporting. Encourage team members to explore automation possibilities within their specific roles.

- Process Redesign: Redesign workflows to incorporate automation seamlessly. This may involve changes to approval processes or the adoption of robotic process automation (RPA) for repetitive tasks.

Step 7: Data-Driven Decision-Making

- Data Training: Offer comprehensive training in data analytics tools & techniques. Show how these tools empower your team to mine insights from financial data & make informed decisions.

- Real-Life Scenarios: Share real-life scenarios where data analysis led to better financial outcomes. Highlight how your team's analytical skills can positively impact the organization.

Step 8: Collaborative Tools and Culture

- Tool Integration: Introduce collaborative tools that facilitate real-time communication & document sharing. Showcase how these tools break down silos & improve cross-functional collaboration.

- Cultural Shift: Promote a culture of openness & knowledge sharing. Encourage your team to actively participate in cross-departmental discussions & projects.

Step 9: Security and Compliance Assurance

- Data Security Training: Conduct training on data security best practices. Explain how embracing digital transformation enhances data protection & ensures regulatory compliance.

- Regular Audits: Emphasize the importance of regular security audits & compliance checks. Make it clear that these processes protect both the organization’s & client's interests.

Step 10: Continuous Learning and Growth

- Skill Development Plans: Create personalized skill development plans for your team members. Encourage them to acquire new digital skills that align with their roles & career aspirations.

- Learning Resources: Provide access to online courses, webinars & workshops. Showcase success stories within your organization where upskilling led to career growth.

Step 11: Progress Tracking and Recognition

- KPI Dashboards: Develop Key Performance Indicator (KPI) dashboards that allow your team to monitor progress in real time. Celebrate achievements as they happen.

- Recognition and Rewards: Publicly recognize & reward team members who contribute significantly to the transformation journey. Make them feel valued & appreciated.

Step 12: Continuous Improvement and Adaptation

- Feedback Channels: Establish clear feedback channels. Regularly seek input from your team on what's working, what needs improvement & what new opportunities exist.

- Agile Approach: Embrace an agile mindset. Be ready to pivot & adjust your strategy based on evolving business needs & technological advancements.

Real-world examples of Digital Transformation in Finance and Accounting:

1. Bank of America:

Bank of America is using artificial intelligence (AI) to automate tasks & enhance customer service. The bank is using AI to detect scheming transactions & to deliver personalized financial guidance to the customers. This has significantly reduced the number of fraudulent transactions & has enhanced customer satisfaction.

2. KPMG:

KPMG is using blockchain technology to improve the efficiency of its audit processes. The company is also using blockchain to build a more secure & transparent way to share data with clients. This has improved the trust that clients have in KPMG's audit services & has made it simpler for the company to cooperate with clients.

3. PwC:

PwC is using robotic process automation (RPA) to automate tasks such as invoice processing & data entry. This has freed up time for the company's accountants to focus on more strategic activities, such as risk management & compliance. This has improved the quality of PwC's work & has reduced the risk of errors.

Tips for a smoother digital transformation journey in a finance and accounting team:

Digital transformation in finance and accounting is a rewarding journey, but it's not without its challenges. To help you navigate this transformation smoothly & ensure your team's success, we've compiled a set of valuable tips. These insights will act as your compass, guiding you toward a more efficient, accurate & strategically impactful future.

1. Start with Clear Objectives:

Define specific goals for your finance and accounting team's digital transformation. Are you aiming to improve reporting accuracy, enhance compliance, or streamline accounts payable processes? Having clear objectives ensures that your efforts are focused & measurable.

2. Assess Current Processes Thoroughly:

Before implementing digital solutions, conduct a comprehensive assessment of your current financial processes. Identify bottlenecks, pain points & areas where automation or technology can make the most significant impact.

3. Invest in Training and Upskilling:

Equip your finance and accounting team with the necessary digital skills & knowledge. Provide training on new tools & technologies to ensure your team can effectively leverage them for enhanced productivity and accuracy.

4. Data Quality and Governance:

Establish data quality standards & governance protocols. Accurate & clean financial data is the backbone of effective digital transformation in finance and accounting.

5. Choose the Right Technology Partners:

Select digital solutions that are specifically designed for finance and accounting functions. Ensure that the technology aligns with your team's unique requirements, such as compliance & reporting needs.

Conclusion:

By embracing automation, embracing collaboration, and staying agile, your finance and accounting team can become the strategic force that drives your organization forward. It's not just about numbers; it's about shaping the financial destiny of your company. If you are looking for the best solution for your Finance and Accounting Team, unlock the future of finance and accounting with Hybrowlabs. Discover why partnering with us is your gateway to a smarter and successful financial future. Explore our services now and grab the success!

FAQ:

1. What is Digital Transformation in Finance and Accounting?

Digital Transformation in Finance and Accounting refers to the adoption of digital technologies & tools to streamline financial processes, improve data accuracy & enhance decision-making within finance & accounting functions.

2. Why is Digital Transformation important for Finance and Accounting Teams?

Digital Transformation is essential as it enhances efficiency, accuracy & agility in financial operations. It also allows finance & accounting teams to provide real-time insights to support strategic decision-making.

3. What are some common digital tools used in Finance and Accounting Digital Transformation?

Common digital tools include cloud-based accounting software, data analytics platforms, robotic process automation (RPA) & digital document management systems.

4. Are there any risks associated with Digital Transformation in Finance and Accounting?

While the benefits are significant, there are risks, including data security breaches, implementation challenges & the need for ongoing investment in technology.

5. What is the future of Finance and Accounting in the digital era?

The future involves continued evolution & integration of technologies like artificial intelligence, blockchain, & advanced analytics, making finance and accounting even more strategic & data-driven.

a3dc85.jpg)

.jpg)

fd8f11.png)

.jpg)

.jpg)